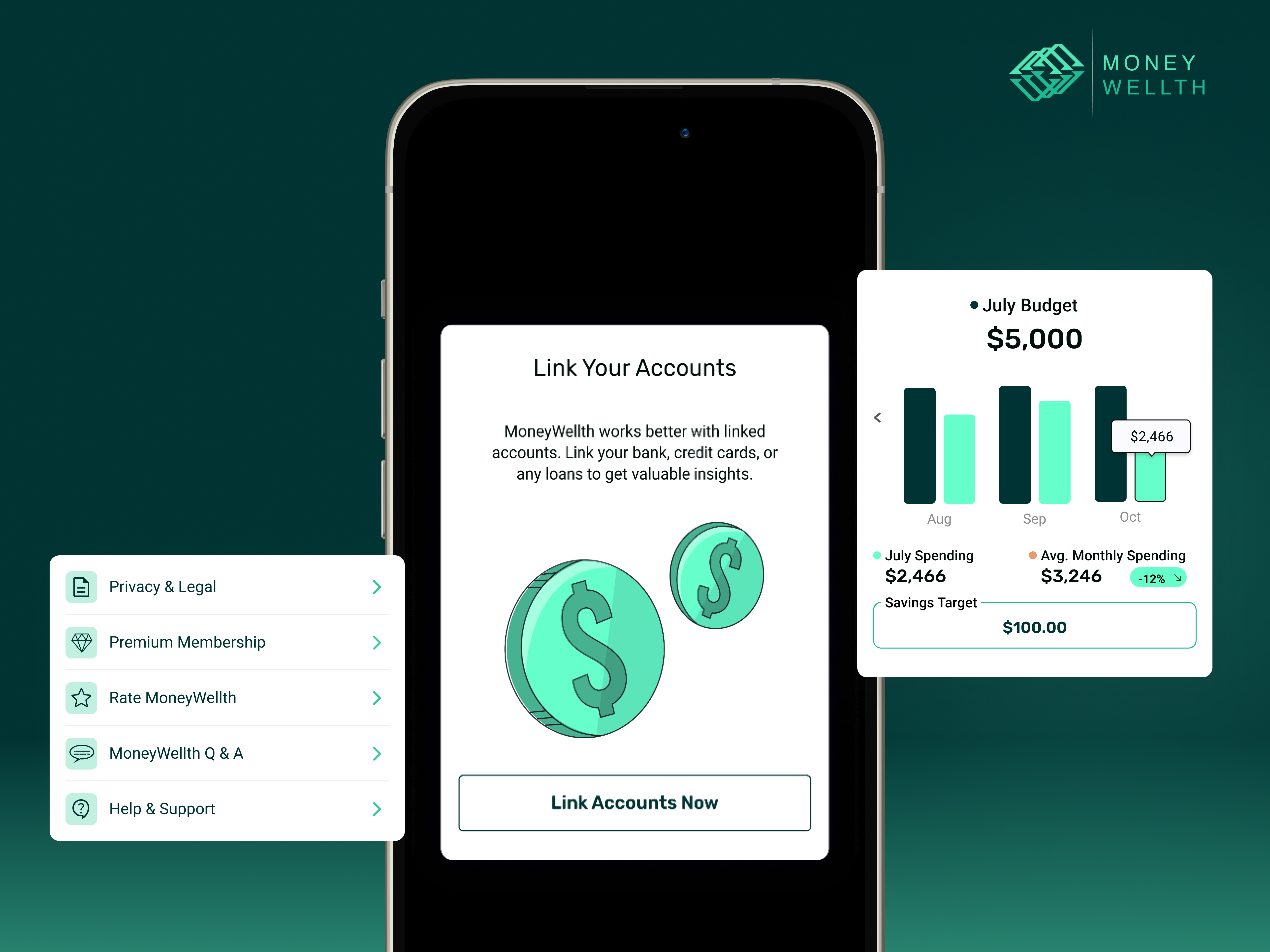

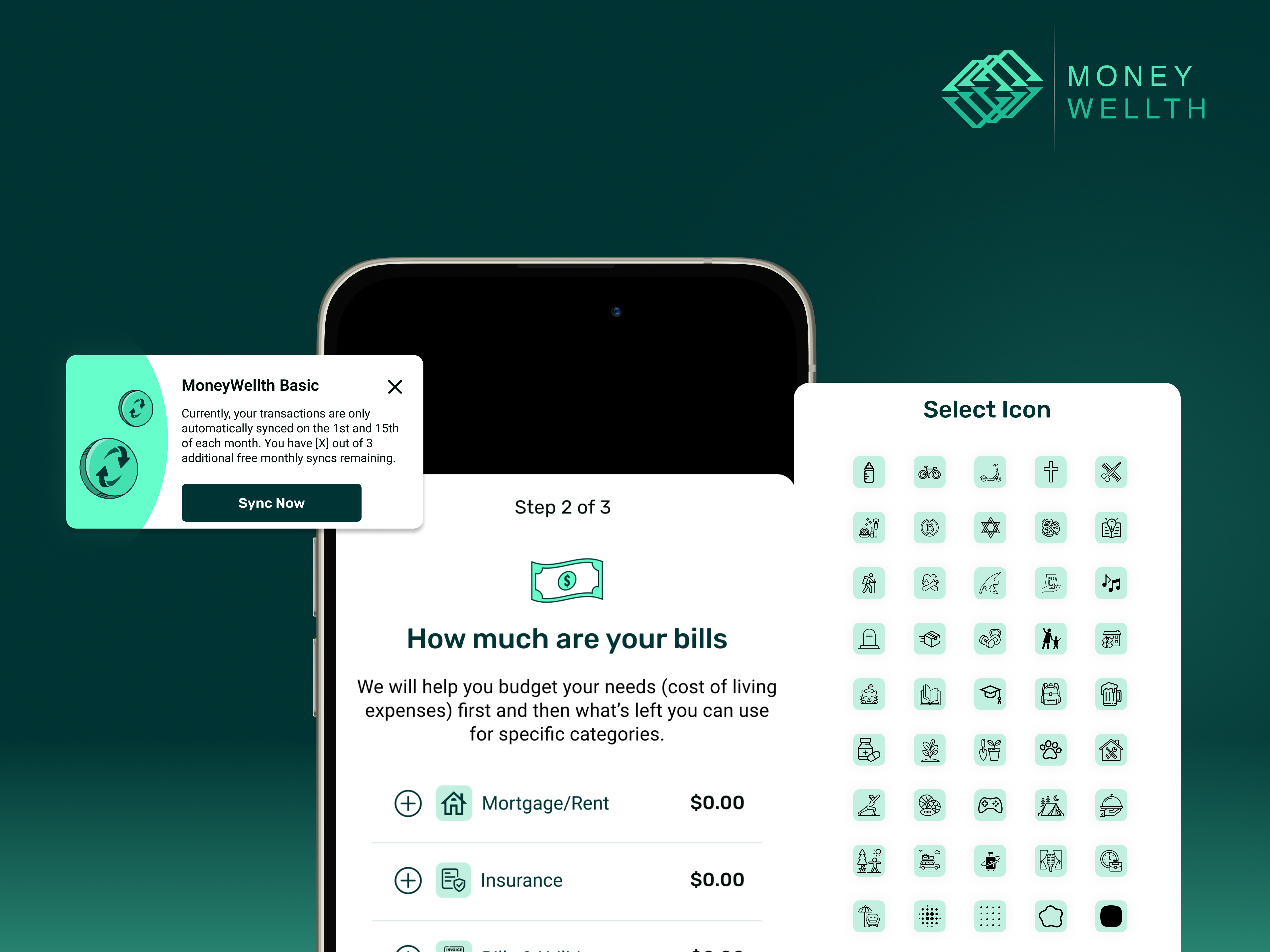

What’s New at MoneyWellth: Enhanced Budgeting & Easier Customization

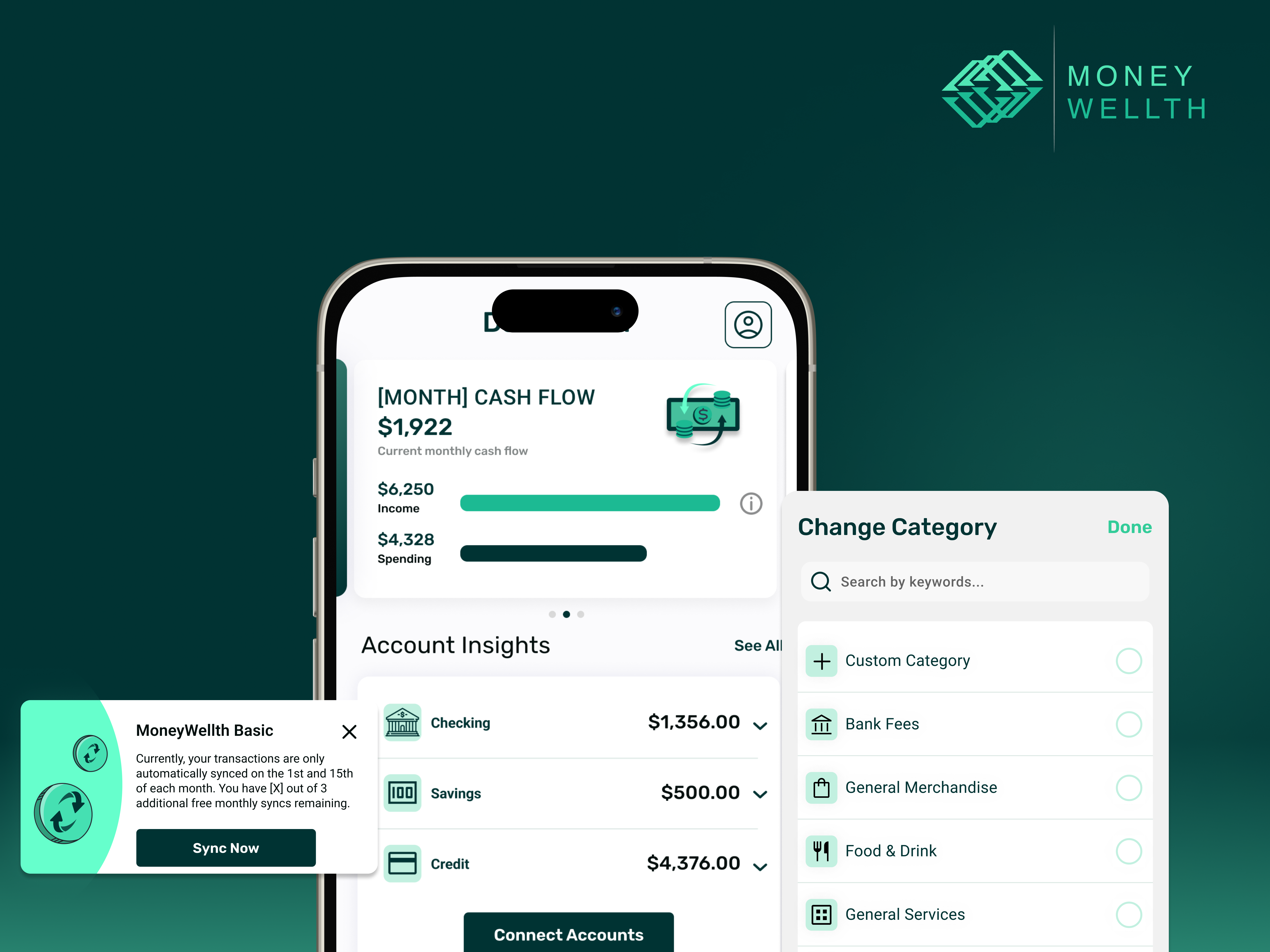

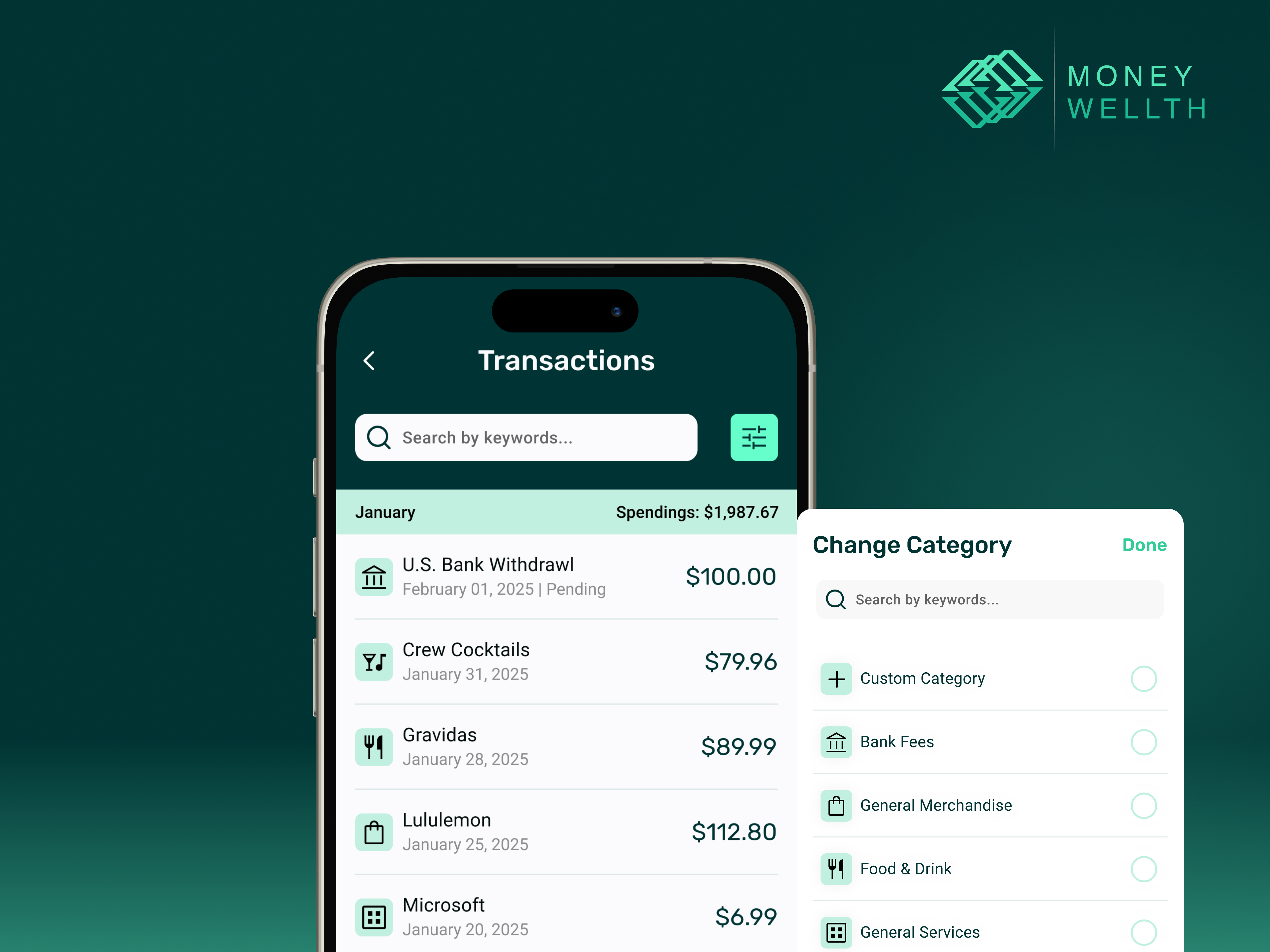

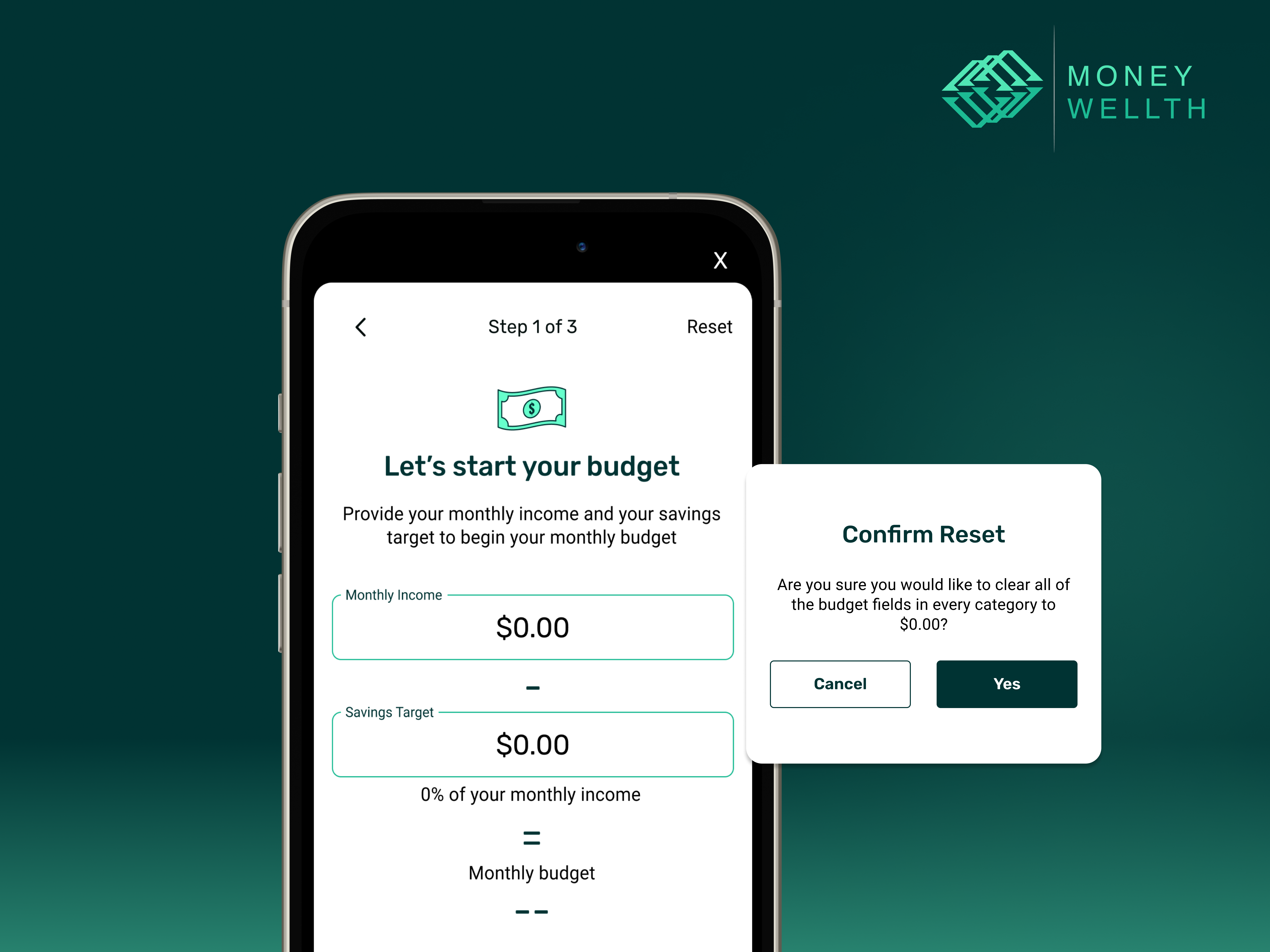

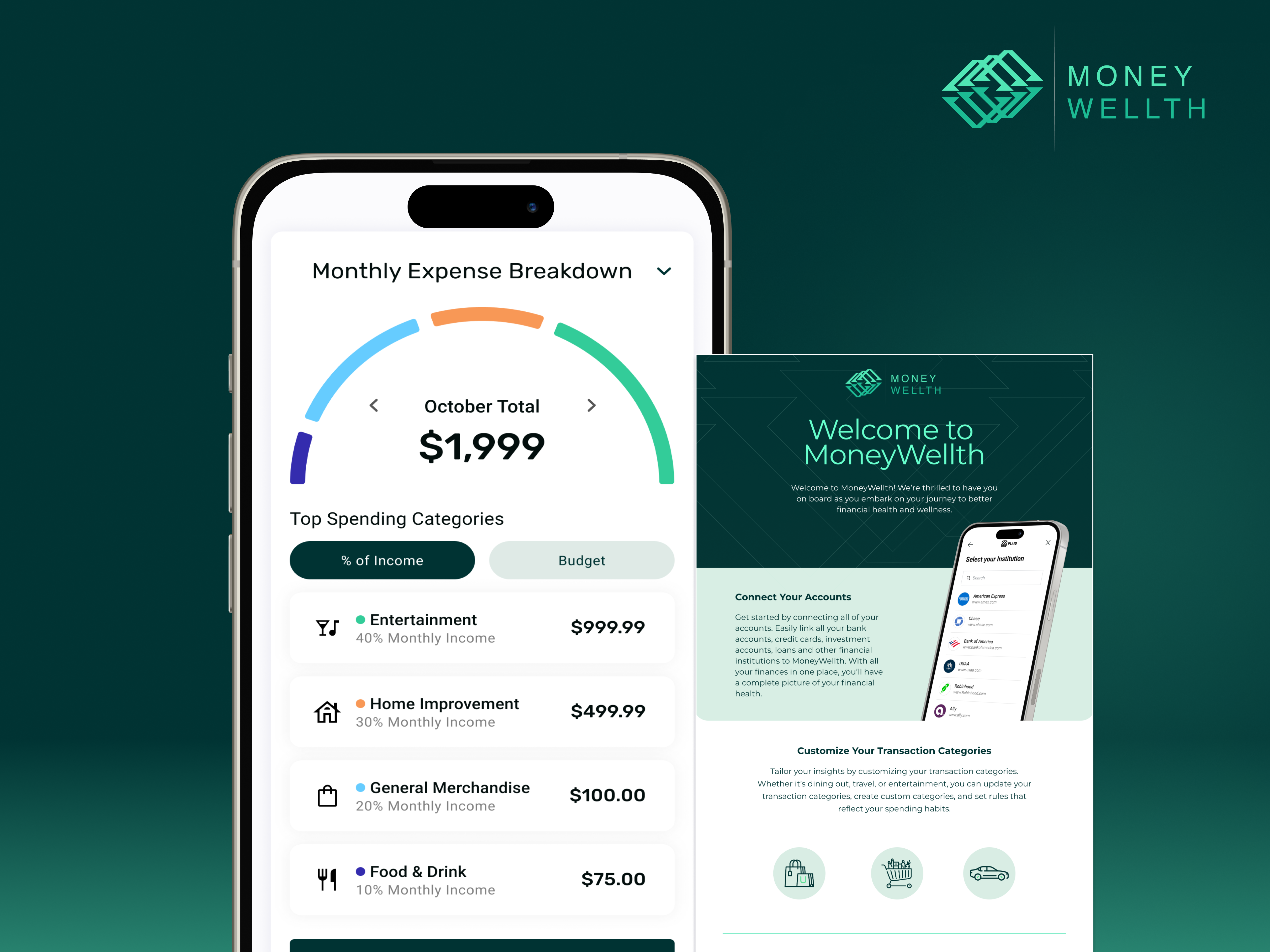

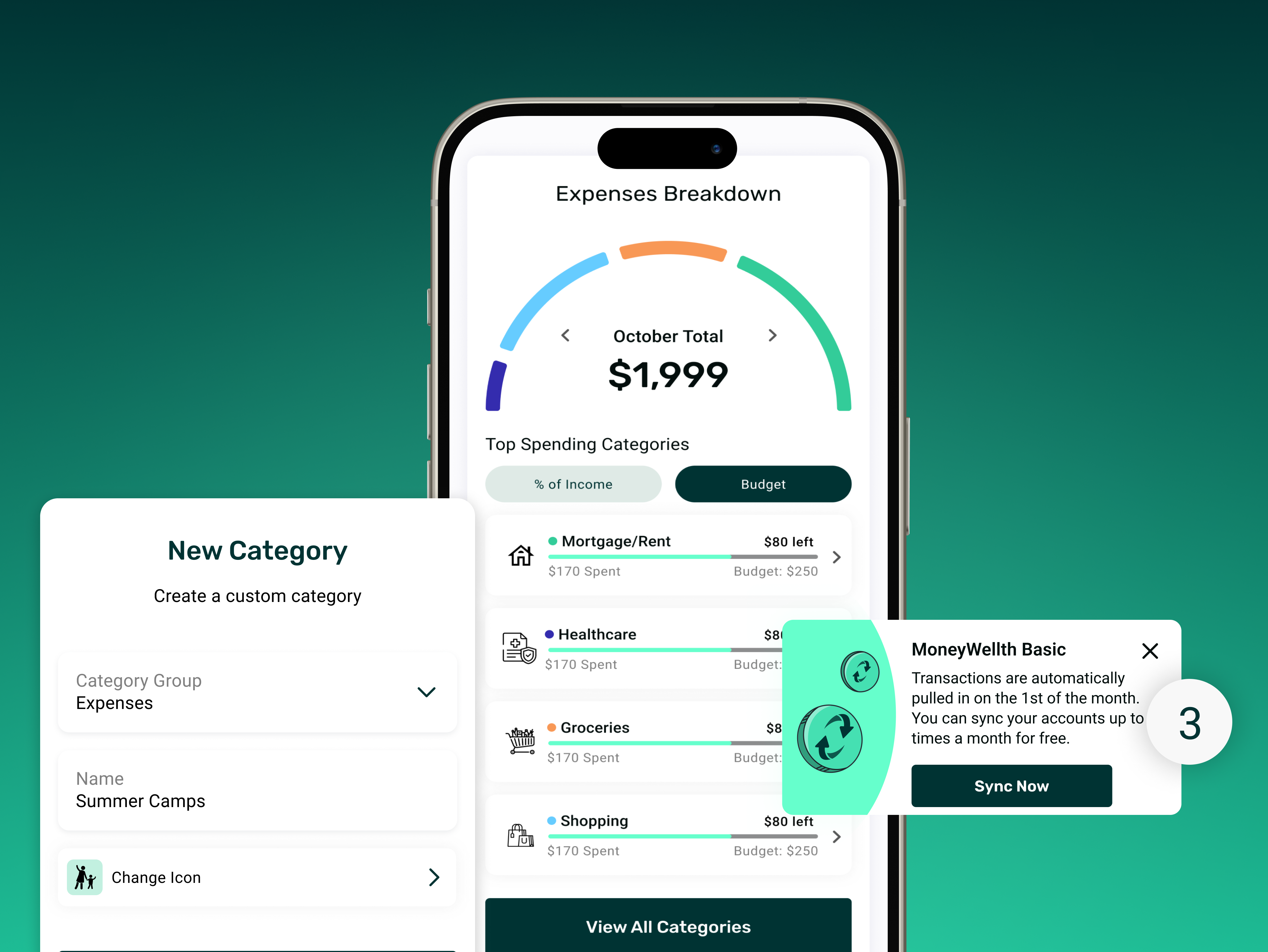

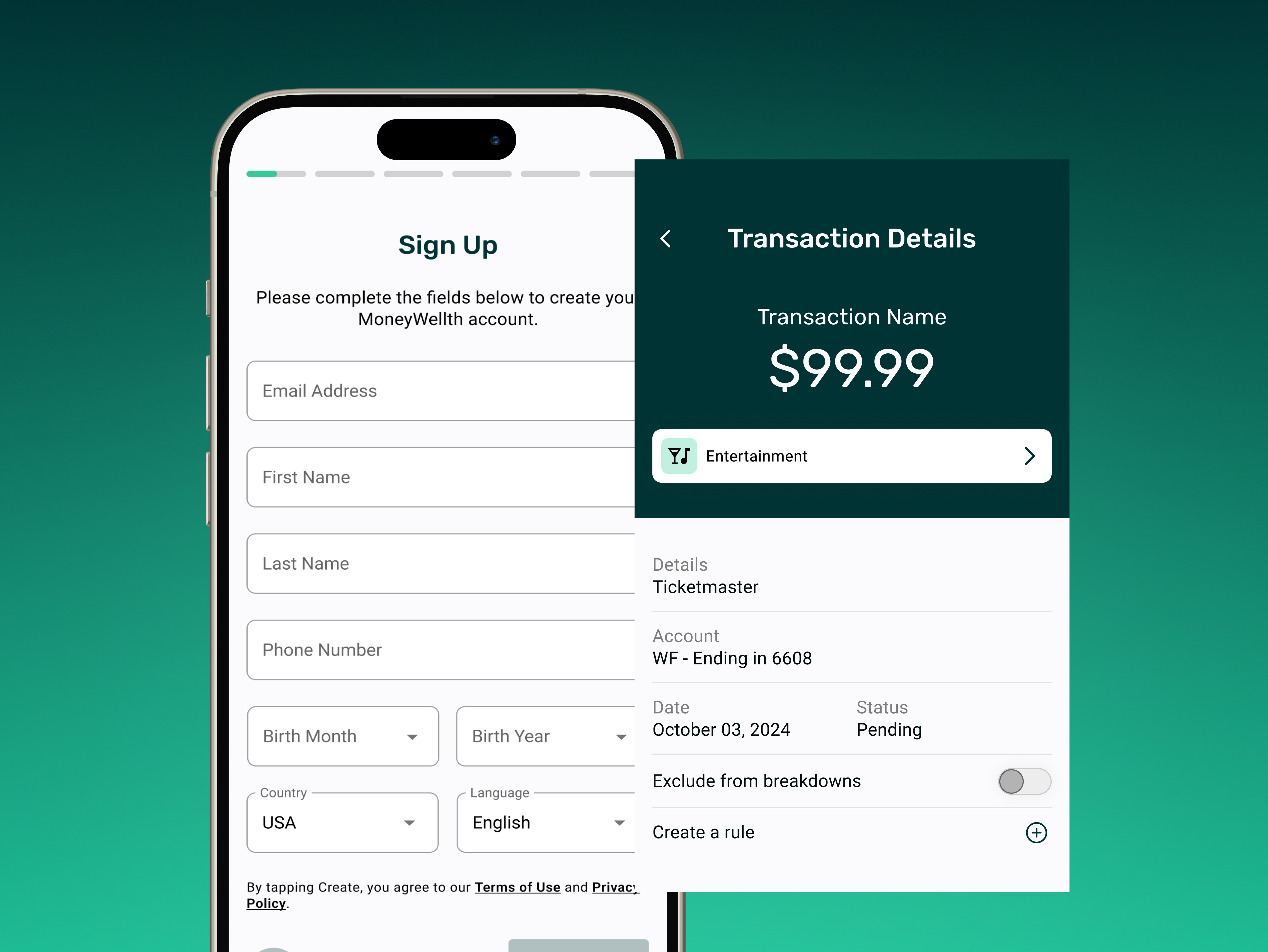

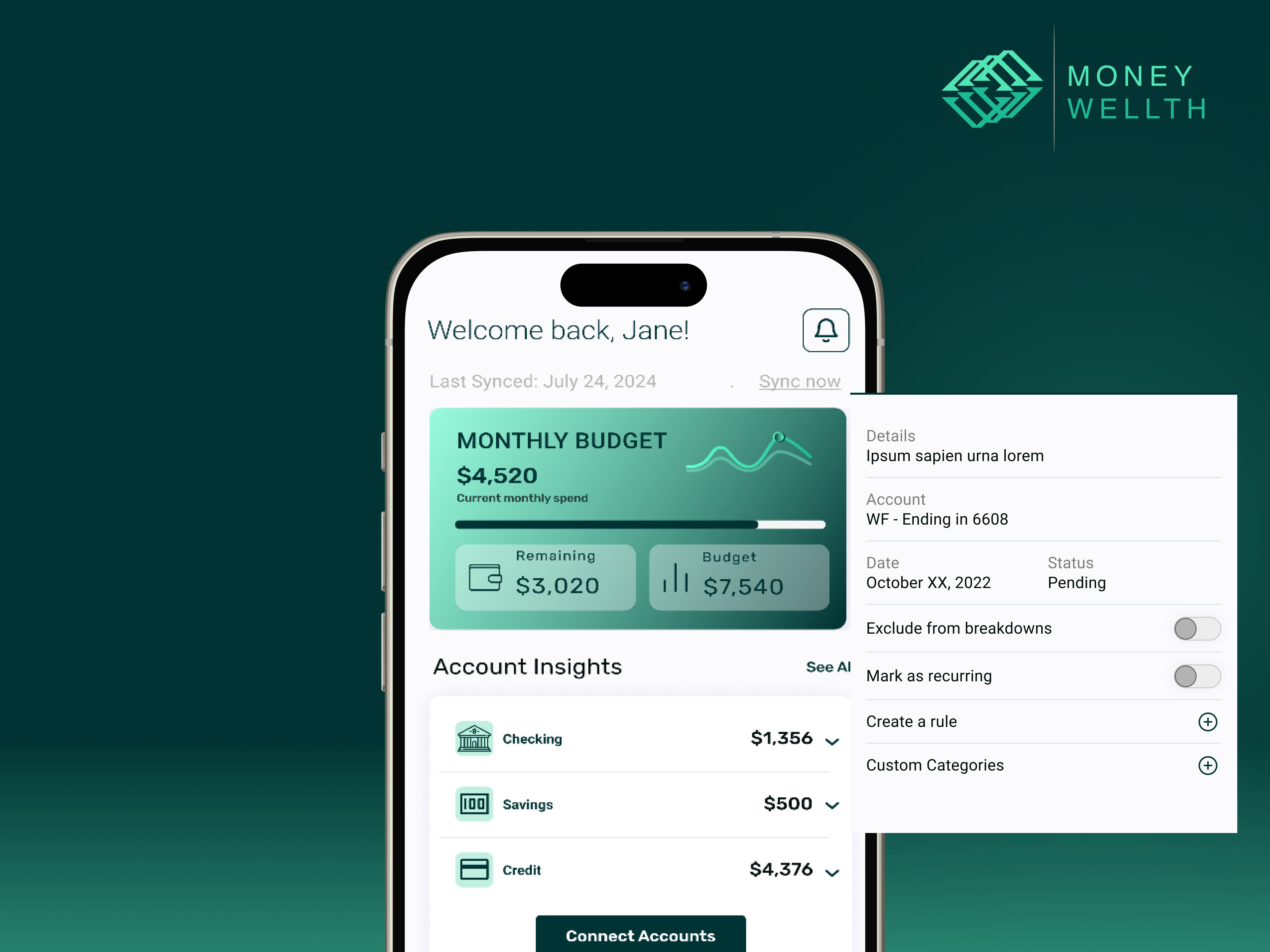

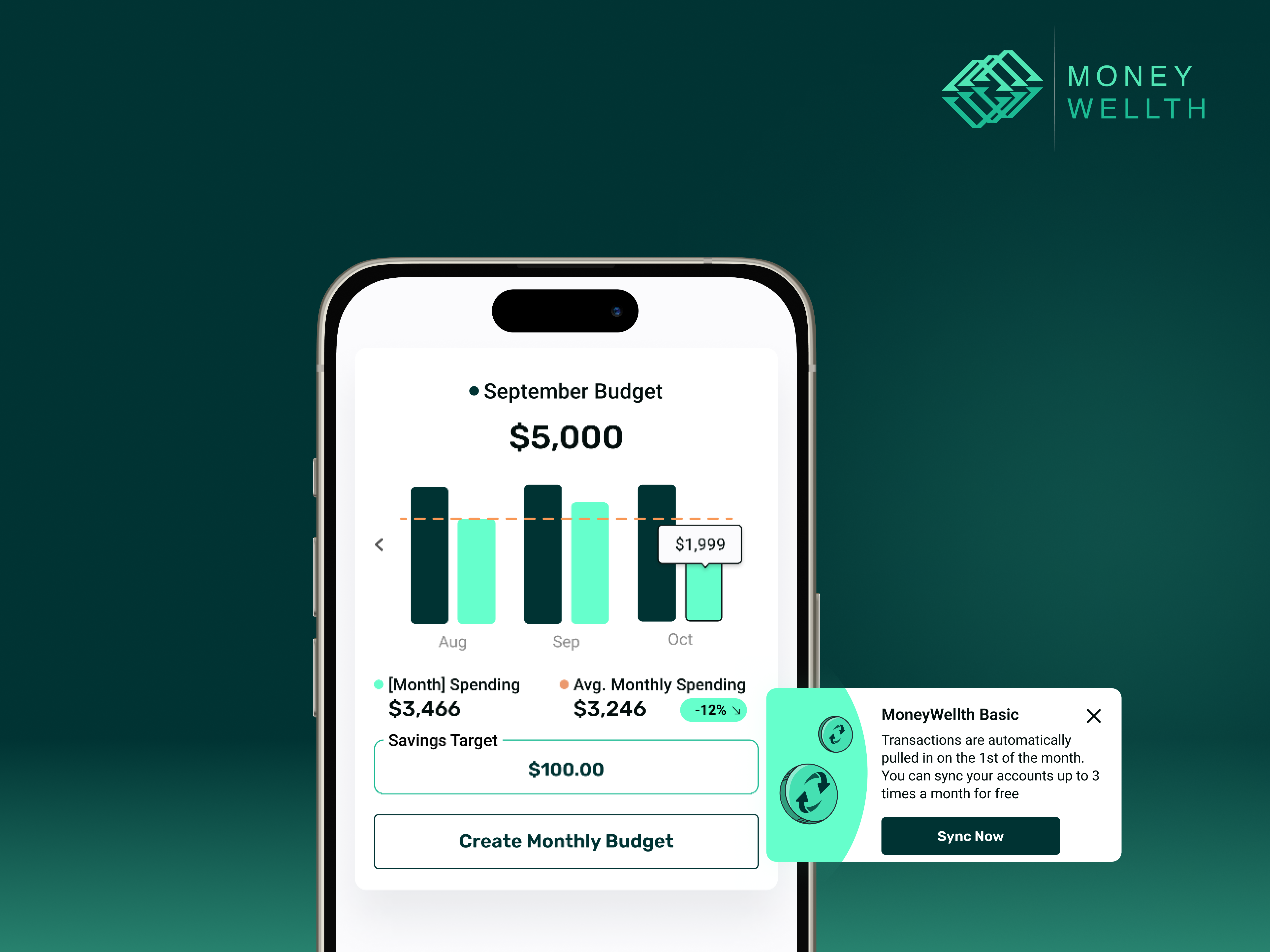

What’s new at MoneyWellth We’re always working on new features and improvements and today’s release is one that we are all excited about. New Features and improvements released today: More Icons, More Personalization We’ve expanded our custom category icon set so you can better match your spending to what matters most. Whether it’s coffee runs … What’s New at MoneyWellth: Enhanced Budgeting & Easier Customization